Bookkeeping Software

Overview

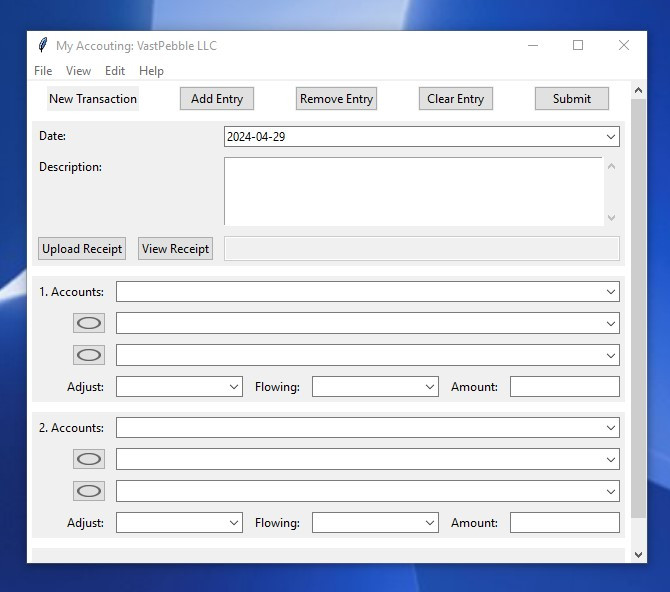

This bookkeeping software allows users to log transactions, create multiple businesses, perform data backups, review balances, and make account adjustments. It is designed for Windows systems; please contact us for registration after downloading, with the current price set at $100 per year.

Tutorial

1. Start Business

Adam and Mark have launched a new business called "WonderBusiness LLC" and within the software, they have the capability to create a new business. For more information, please refer to the accompanying video.

Tutorial

2. Add Accounts

Adam and Mark established a Bank of America Checking account for WonderBusiness LLC and made an initial contribution to their new venture. We will create the bank account under "Asset/Cash | Current" and add two contribution accounts for Adam and Mark under "Equity/Contribution". Please consult the accompanying video for further details.

Tutorial

3. Record Contribution

Adam contributed $10,000, and Mark contributed $5,000 to the company, totaling $15,000. Adam holds a 2/3 membership interest, while Mark holds a 1/3 interest. The contribution process is demonstrated in the accompanying video.

Tutorial

4. Record Income

WonderBusiness LLC earned $2,000 from its operations and deposited this income into the Bank of America checking account. We will record this income under the account "Other Income/Other Income." Additionally, Adam and Mark have the option to create their own income account and record the income accordingly.

Tutorial

5. Record Expense

WonderBusiness LLC incurred a $500 expense for product storage, paid directly from the Bank of America checking account. We will categorize this expense under the account "Occupancy Cost/Rent Expense." Moreover, Adam and Mark can choose to create their own expense account and record the expense accordingly.

Tutorial

6. View Balance

Adam and Mark have the ability to check the balances in each account. For instance, the Bank of America Checking account should show a current balance of $16,500, with income reflecting a credit of $2,000 and expenses showing a debit of $500.

Tutorial

7. Export Records

Adam and Mark can export all business transactions, as well as generate and export the income statement, statement of owner's equity, and balance sheet as needed. For more information, please refer to the accompanying video.

Tutorial

8. Search Account

Selecting accounts during transaction recording can be cumbersome. Our tool includes a search function for swift account retrieval. For more information, please refer to the accompanying video.